Credit Karma USA 2024 Get Started For Free at Credit.com

Credit Karma is a famous American multinational personal finance company. It is a free financial app. Increases your credit awareness. It also provides innovative information on loans, selected financial products, credit cards, mortgages, insurance, and car loans.

Credit Karma offers a checking account to help improve low scores. In this article, we will discuss Karma in detail. Watch this article if you are interested in Karma and want to collect the necessary information.

What is the Credit Karma?

We use our love of data to analyze your credit profile and make product recommendations that could help you save money.

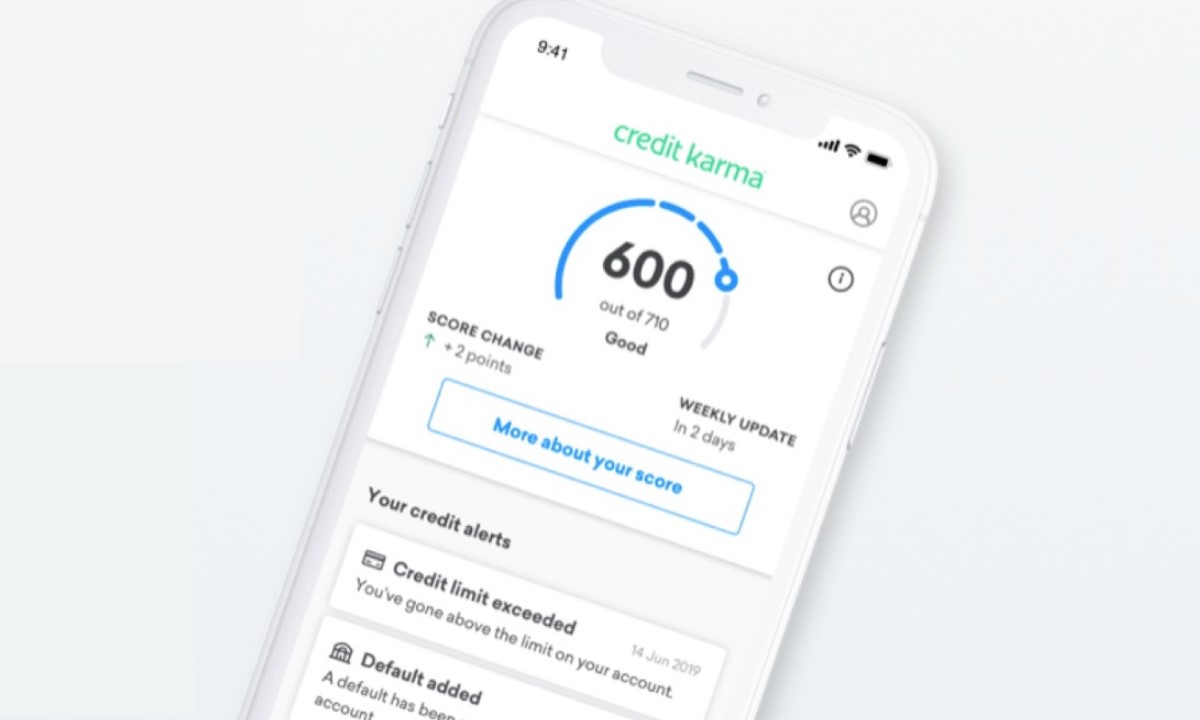

Credit Score:

A credit score is a measure of creditworthiness. When applying for a loan or mortgage, a dealership or a bane checks your creditworthiness and the likelihood of making complete and timely repayments. Based on compensation, the credit bureau score is compiled by three major credit bureaus: Equifax, Experian, and TransUnion.

Credit Score is central to Credit Karma and other personal Finance apps like WalletHub and Sesame. Monitoring credit scores is one way to keep an eye out for financial fraud. If someone takes out a loan or line of credit in your name and you don’t form it, your credit score can decrease.

- Parent organization: Intuit

- Founded: March 8, 2007

- CEO: Kenneth Lin (Mar 2007–)

- Subsidiaries: Noddle, SeedFi, Inc.

- Founder: Kenneth Lin

- Headquarters: San Francisco, California, United States

- Number of employees: 1,500

Required information to be provided to use Credit Karma 2024:

To use Credit Karma, some personal details must be provided. It is given below.

- Name

- Address

- Social Media Security Number,

- A bio profile

- Estimation of net worth

- Address of owned house if rented house

- Details about the vehicle

2024 Credit Karma Focus:

After logging into Credit Karma, you will receive two scores from TransUnion and Equifax. WalletHub and Credit Sesame offer free versions of this. The Karma app also provides critical numbers, such as home equity and borrowing power.

The app then instantly suggests financial products. They show ads. Karma can be helpful for new credit cards or bank accounts. Get more recommendations for auto insurance, credit cards, home equity loans, etc.

How does Credit Karma Recommend Financial Products?

Credit Karma recommends financial products through its reviews, user reviews, descriptions, and comparisons. It also provides editorial content and objective analysis. However, if you see recommendations labeled “Karma Guarantee” that require your odds to approve the proposal and are not supported, Karma is willing to pay $50. You can also easily search for credit cards using rewards and balance transfer filters.

Credit Karma Banking Services:

Credit Karma offers two bank accounts, a savings and a checking account, through MVB Bank, Inc., a member of the FDIC. These are optional, requiring a checking account to use the bill tracking and credit builder features. Credit Karma Money Save is a savings account that can earn high-interest rates.

A Visa Debit Card is included. No fees are payable for the accounts. Credit Builder is a program that helps people build good credit. A TransUnion credit score of 619 or lower can apply for it. With it, you can get a $1,000 credit through the combination savings account and Cross River Bank, FDIC. You can also increase your credit limit by signing up. Timely payment reports to three credit bureaus for extending credit. It is entirely free and has no fixed term.

Is Credit Karma Free?

Credit Karma receives compensation from companies displaying financial products on the Site. Karma reviews the companies’ editorial content. Advertisers may influence how and where products are displayed on the Site. But it’s also worth noting that Credit Karma’s offerings do not represent the entire world of financial services companies and products.

Security Features of Credit Karma 2024:

Credit Karma has some Sophisticated Security features. Let’s take a look.

- 128-bit or higher encryption,

- Multi-factor authentication

- Security questions.

- Automatically sign out after inactivity.