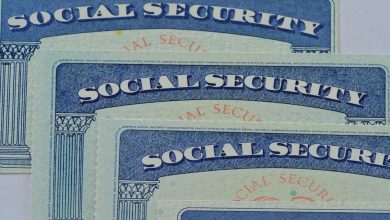

Social Security Benefits 2024: How Much Will Recipients Get?

Social Security Benefits – 2024: How Much Will Recipients Get?! Social Security Benefits 2024 Update! With rising inflation, millions of Social Security retirees may face the most considerable cost-of-living adjustment (COLA) in four decades.

How much additional Social Security recipients, injured veterans, and government retirees will receive in 2024 will be disclosed in the fall. However, an advocacy group, the nonpartisan Senior Citizens League, has calculated that the 2024 COLA might reach 10.5 percent.

If that happens, the most significant rise in Social Security payouts since 1981 will be well above the 5.9 percent COLA for 2023. According to CNN, the average retiree receives a monthly pension of $1,688. A 10.5 percent COLA for 2024 will increase it by nearly $175. The projection by the advocacy organization is based on the June data of the Consumer Price Index for Urban Wage Earners and Clerical Workers, which indicated prices climbed by 9.8 percent over the previous year.

Analyzes the Index’s Average

The Social Security Administration analyzes the index’s average inflation in the third quarter of each year to determine how much to boost Social Security payments the following year. If the present inflation pattern continues, the COLA adjustment for 2024 may be as high as 11.4 percent., according to the Committee for a Responsible Federal Budget. If inflation maintains June values, the COLA will be 9%.

The COLA goal is to keep Social Security benefits’ purchasing power and mitigate rising costs’ effects on individuals on fixed incomes. However, inflation has surpassed the 5.9 percent COLA adjustment for 2024. Keeping many seniors in financial distress as costs continue to rise, according to Mary Johnson, the policy analyst at the League.

“Because inflation has been so high, and so much more than the 5.9 percent COLA that folks received,” Johnson explained, “they have faced a deficit in their benefits.” “People are putting on more consumer credit cards if they do not have appropriate retirement savings or cash reserves that are easily accessible.”

The COLA Rise may not be sufficient for Beneficiaries.

Although Social Security payouts may climb at their fastest rate in 40 years, retirees who rely on Social Security income may face difficulties. According to experts, COLA does not account for essential costs for senior folks.

Furthermore, increased income might result in the loss of healthcare and prescription drug coverage for low-income participants. Furthermore, the historically large projected increase could result in significant taxes for persons with salaries exceeding $25,000, according to the group.

“The Senior Citizens League expects that tens of thousands of pensioners who have not previously paid taxes on their pensions may realize that they must begin doing so in 2024,” the organization claimed. Consider consolidating and paying off your debt with a personal loan to lower your monthly expenses.

Which States Tax Social Security Benefits?

12 states currently tax Social Security benefits—Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont, and West Virginia.

Social Security Funds may Endure Longer than Anticipated.

The SSA recently announced a fresh prognosis for its trust funds. This indicates that its money may survive a little longer than previously anticipated. Social Security funds are expected to run out by 2035, one year after the SSA predicted last year. Benefits provided to Social Security claimants will be lower by 20% if this occurs.

The combined funds of the OASI Trust Fund and DI Trust Fund fell by $56 billion to a total of $2.85 trillion. 2023, the program’s total annual cost is expected to exceed its entire yearly income. In fact, since 2010, the expense of Social Security has exceeded its revenue

Social Security Benefits – (2024 Update): How Much Will Recipients Get?

| Year | Beneficiaries | Dollars |

| 2010 | 54,031,968 | $701,609,000,000 |

| 2011 | 55,404,480 | $725,103,000,000 |

| 2012 | 56,758,185 | $774,791,000,000 |

| 2013 | 57,978,610 | $812,259,000,000 |

| 2014 | 59,007,158 | $848,463,000,000 |

| 2015 | 60,907,307 | $886,278,000,000 |

| 2016 | 60,907,307 | $911,384,000,000 |

| 2017 | 61,903,360 | $941,499,000,000 |

| 2018 | 62,906,222 | $988,635,000,000 |

| 2019 | 64,064,496 | $1,047,930,000,000 |

Social Security Benefits 2024: A higher COLA could influence Social Security’s solvency. A higher 2024 COLA could not be all good news. Meanwhile, as their monthly checks climb, lower-income beneficiaries may have income-related benefits reduced, she warned.

Based on the Committee for a Responsible Federal Budget, a nonprofit, nonpartisan group. A record-high Social Security COLA in 2024 would impact Social Security’s estimated depletion dates. In June, the annual Social Security trustees report projects that the program’s combined reserves would be spent in 2035.

At this point, 80% of benefits would be due. This is based on statistics through the middle of February. Using more recent inflation projections, the Committee for a Responsible Federal Budget predicts that Social Security will become insolvent in 2034 rather than 2035.