Best Term Insurance: What Is term Insurance & How Does It Work! Term insurance is a form of life insurance policy that offers protection for a certain “term” of years or a set amount of time. A death benefit will be granted if the insured passes away. within the time-frame indicated in the contract and also if the policy is effective or in effect. In the beginning, term insurance is far less expensive than permanent life insurance. The term doesn’t have a financial value, unlike the majority of permanent options. Otherwise, the policy’s guaranteed death payout is its sole worth. For the duration of the policy, many policies give level rates. Other plans provide the ability to switch from to lifelong. As well as benefits that increase or decrease over time.

Types of Term Insurance:

In addition to the level of term insurance, we’ve described so far, there are other types of term insurance. Depending on the demands of the policyholder, each policy offers advantages and disadvantages.

(i) Convertible Term: A term insurance policy, that has a set number of years before expiration, can change into a whole life or everlasting policy thanks to convertible life insurance.

(ii) Increasing Term: Some insurance let you gradually boost the death benefit. Although the premium rises as well, policyholders can afford to pay smaller premiums in their early years of life. while they have numerous expenditures and obligations. As would be the situation with conventional term insurance. The rising term removes the need to enroll for a further policy at an advanced age to receive the additional payout.

(iii) Mortgage term or decreasing term: The death benefit value reduces with time under declining term policies, which are the reverse of rising term policies. The objective is to align the drop in term benefit with the decline in the mortgage balance owed by the policyholder. The rationale behind this method is that if you have less mortgage debt, you won’t need as much life insurance. However, even though the premium payments are lower than those for term insurance, they don’t change when the benefit decreases.

(iv) Annual Renewable term: The term insurance is required to be registered. But the renewal premium is greater because the insured is a year older. The advantage of annual renewable term insurance is that it will always be authorized for coverage. Due to the escalating prices, it might not be the best economical option for everyone.

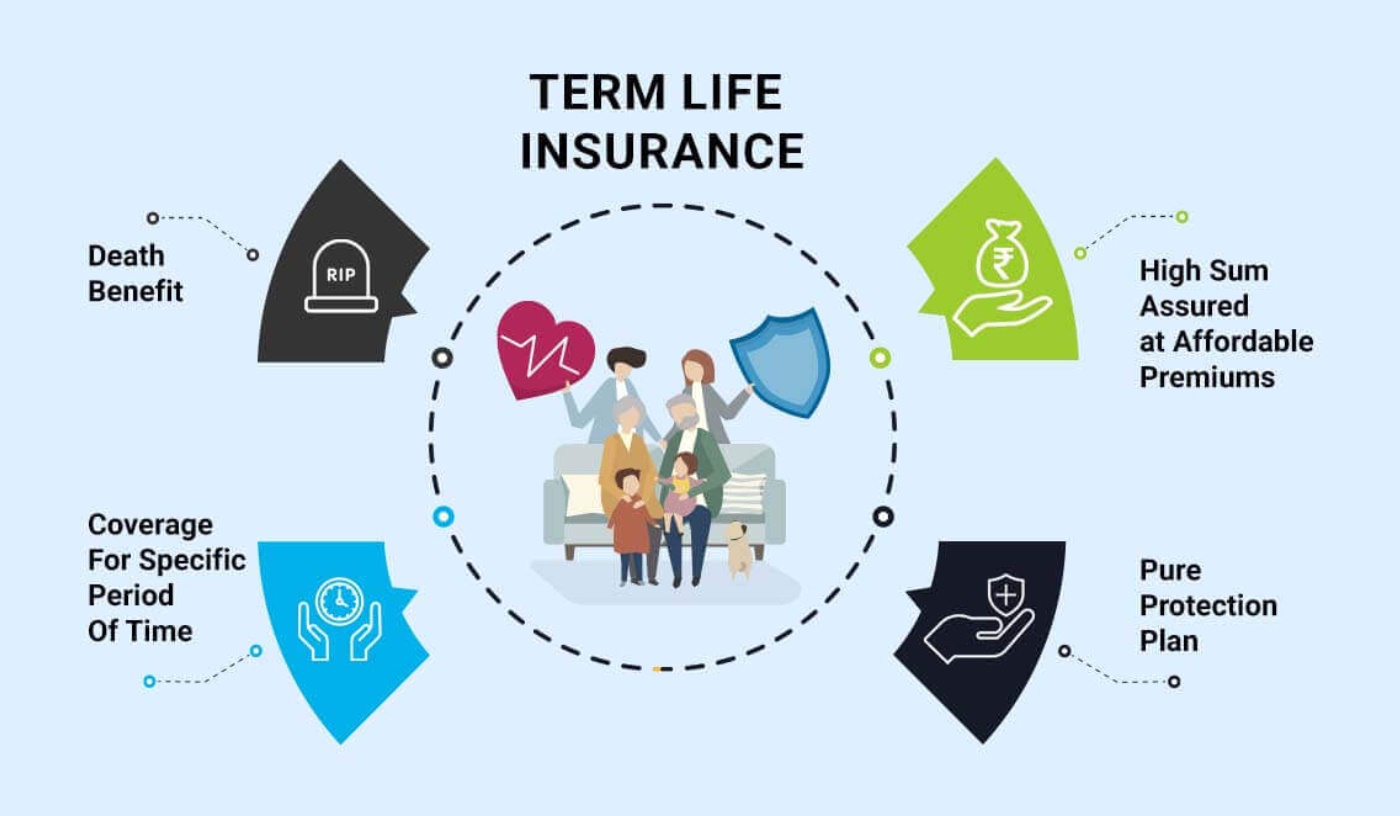

Services of Term Insurance: The cheapest and purest type of life insurance is the term. At the most reasonable prices, it offers your family financial safety. Users can obtain substantial life insurance (also known as sum assured) for a comparatively modest premium cost. If the insured person passes away within the policy’s term, the reward amount is paid to the nominee. For total security for you and your family, choose a life insurance policy with a variety of add-on benefits.

Importance of Term Insurance:

- The stability of a family’s finances: When you’re the main breadwinner, purchasing a term strategy would cover your family’s monthly expenses while you are away.

- Pay off your debts: You would have taken out a loan for a vehicle, home, personal use, or education. Your family may encounter financial hardship while you are away due to the payback of these loans.

- lifestyle-related risks: With age, there is a higher chance of having a lifestyle disease. Some term insurance policies include critical sickness coverage, which safeguards your family not only in the event of unforeseen events but also while you are still alive. The critical illness benefit offers you cash protection against a number of serious health issues, including heart attack and cancer.

Overall, Term life insurance appeals to young families with kids. Parents can get a lot of coverage for relatively little money. The sizeable benefit can compensate for lost income in the event of a parent’s passing. However, these programs are also ideal for those who momentarily require a certain level of life insurance. The policyholder might determine, for instance, that by the moment the policy ends. Their survivors won’t require more financial security or will have amassed sufficient liquidity to self-insure.

Finally, we can conclude that if the insured individual passes away. Within a predetermined life insurance. ensures payment of a defined death profit to the policyholder beneficiaries. These policies lack the savings element included in whole life insurance. Products have no significance except for the guaranteed death payout. Additionally, age, health, and life expectancy are all factors that affect the cost of life insurance. However, it can be possible to convert life insurance to whole life insurance, depending on the insurer. Hence, life insurance policies with terms of 10, 15, or 20 years are frequently available.